Master your spending habits

Posted on: 17 November 2022

Until fairly recently in my adult life, I’ve been in the fortunate position to not have to worry too much about my spending habits. I would say I’m quite a conservative spender, and this, coupled with a job in tech for the last decade, has served me well.

Enter: children. You think you’ve got it all worked out and then children come along and throw a grenade in the middle of your finances.

A combination of parental leave, childcare and reduced working hours means my wife and my take-home income has dipped quite considerably since our first child came along at the end of 2019. This was anticipated, and we manage just fine, but in the past year I’ve taken to tracking our expenditure more closely to minimise surprises.

Below is a list of observations and tips I've picked up spending on a tight budget for the past 20 months.

Pay yourself an allowance

Since April 2021, we decided to pay both our salaries into a single, shared account and pay each other an “allowance” (initially £300 a month). This evened out the disparity in our incomes during maternity leave, etc. It was a change which meant tracking my purchases was essential to stay within my means.

The allowed amount has fluctuated in the 20 months that have followed, a period which included our daughter being born. It was reduced to £250 towards the end of 2021 and recently increased to £275.

Track the kind of transaction

First, I differentiate between expected expenditure (subscriptions) and unplanned expenditure (adhoc). Typically, if you know your budget, and you know your recurring monthly payments, you should know exactly how much you can spend on other stuff. This number is really useful to know at the start of the month.

Subscriptions are also notorious for flying under the radar and becoming excess drain on your resources if you're not tracking them.

Understand your budgets

In my system, “budgets” are pots of money payments can come out of. I’ve mentioned the monthly allowance, which is the primary budget I track, however, there will typically be things that don’t fall under this. For me, this includes things like payments I will claim back on my health insurance (dental, optician), my “Chelsea pot” (more on that later), and my savings (for emergencies).

We’re really only interested in the “monthly” budget (where the majority of your payments will come out of), but it’s important to account for all your outgoings so things don’t slip through the net. And, importantly, so you know exactly how much and what you’re spending.

Categorise based on what's important to you

I love to categorise things. Categorising highlights areas of my life that matter to me, and areas that may be leaking money unintentionally. My top 10 categories by total spent of my monthly budget (since April 2021) are:

- 🎁 Gifts: £34/mo

- 🏃 Running: £26/mo

- ⚽️ Football: £25/mo

- 🍻 Drinks: £24/mo

- 🚆 Transport: £23/mo

- 💊 Health: £23/mo

- 🍔 Food out: £18/mo

- 📱 Phone, TV & Internet: £16/mo

- 🎗 Charity: £13/mo

- 👕 Clothes: £12/mo

For me, this provides an excellent insight into my life, and shows the areas I prioritise. I try to categorise less explicitly and instead focus on the purchase's purpose. What it's used for, rather than what it is.

I should note, there are very few of my “personal” purchases I would classify as essential; this is why the majority of our shared income goes into a joint account. This pays for non-negotiables like housing, insurance, childcare and groceries.

My personal allowance pays for my hobbies and social life and is a good indication of what I spend money on for my happiness. This top 10 list accounts for just over 80% of my total expenditure.

The other 20% is made up of minor categories including Snacks, Music, Domains & Servers, Bike and Books.

Leverage smart credit

Having a tight budget does restrict the purchase of high-cost items. This is where credit comes in. First and foremost, this is not financial advice. I am by no means qualified to provide this. In my experience, credit can be leveraged to great effect with a combination of planning, self-control and common sense.

I try to avoid paying interest at all costs, as this quickly eats into your budget for future months. If I must purchase on a credit card, I aim to pay it off in full the following month. However, it’s Monzo Flex which has been a big help this year. In particular, their interest-free, 3-month plans.

Credit is essential for big purchases like a pair of running shoes, a more lavish gift or an annual subscription. Spreading out a payment of, say £100, into 3 smaller payments keeps your cashflow happy and your spending less spiky. Scheduling in these future payments with your other recurring subscriptions gives you the visibility on how much you have left to spend in a given month.

Software is essential

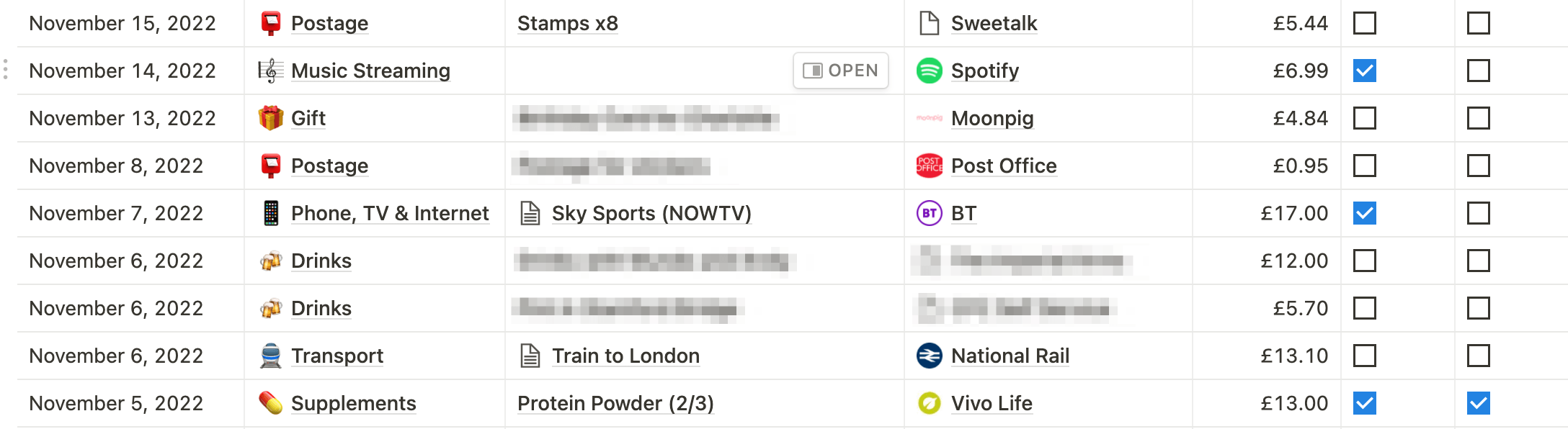

I love Notion, and this is where I record my spending data. For my personal expenditure, I have 3 databases: Payments, Types & Retailers. A payment has a date, a description, an amount, a type, a retailer, a budget selector, a subscription toggle and a Flex toggle.

Types (categories) aggregate total spend, number of purchases, average purchase price and average spend per month.

I calculate average spend per month using the following formula:

prop("From Monthly Budget") / dateBetween(now(), fromTimestamp(1617231600000), "months")The “From Monthly Budget” property is the sum total of payments that come out of my monthly budget. dateBetween calculates the number of months between now and a hard-coded timestamp equal to 1st April 2021 (the day I started tracking).

Retailers are less important for tracking, but still useful information to keep. Particularly when analysing over a period of time.

The humble spreadsheet

Notion is great at the above, but where it struggles, I find, is aggregating data grouped by time. Luckily, a spreadsheet is perfect for this, so I supplement my Notion databases with a Google Sheet. With the help of database views in Notion, each month I manually copy over totals from Notion into Google Sheets. This includes:

- Budget

- Total spent

- Surplus (budget - total spent)

- Subscriptions total

- Non-subscriptions total (adhoc spending)

- Credit/Flex total

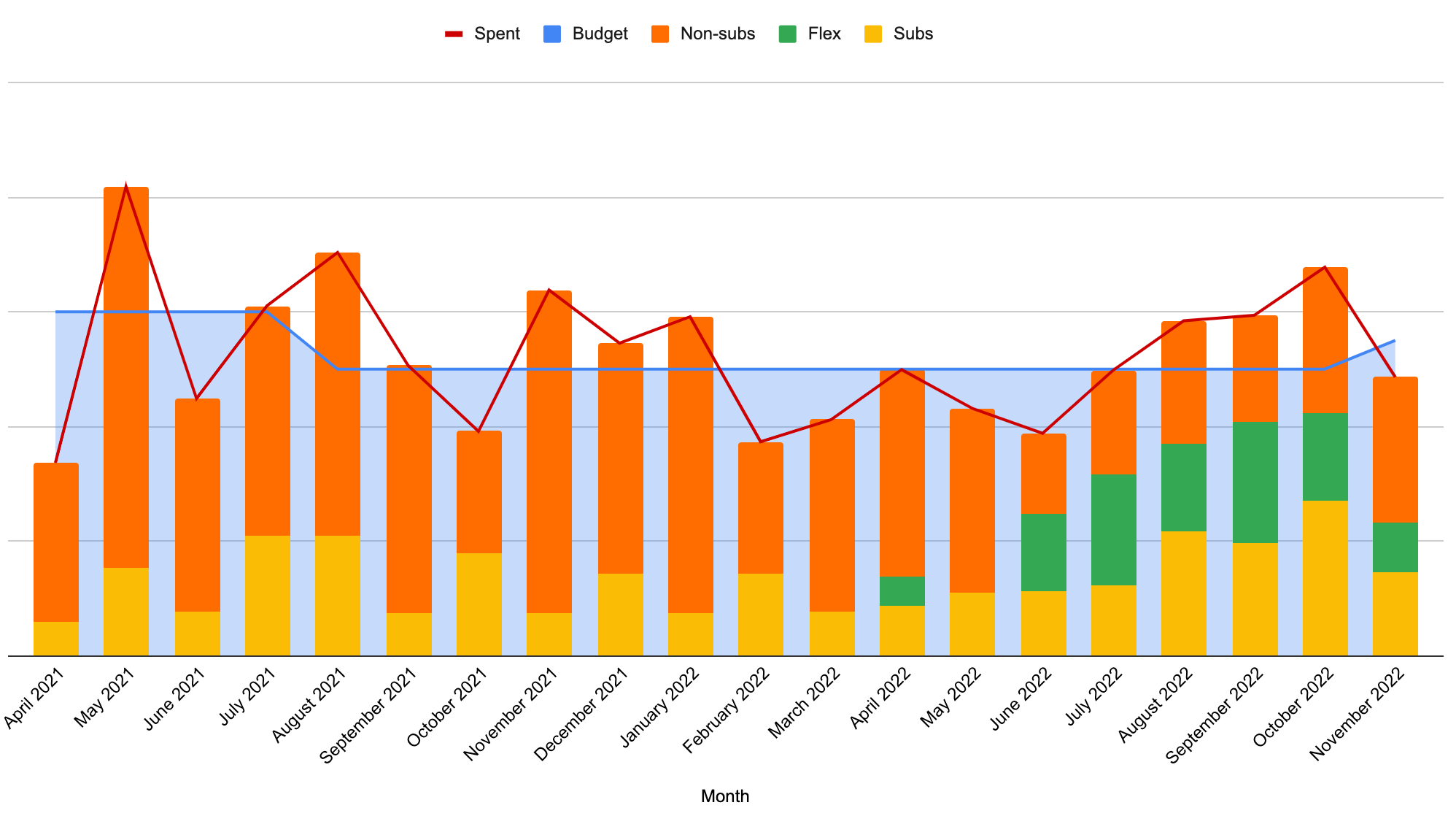

Having this data in a spreadsheet makes producing graphs a cinch:

Spotting trends

Graphs are incredibly useful, because on the whole, we tend to digest visual things better than numbers. At a glance I can see from the above chart that since introducing Monzo Flex (green on the chart), my monthly spending has fluctuated less. However, with it, I can see I’m spending more on the whole (a habit I’m beginning to reign in).

Flex has smoothed out non-monthly payments like my 10-weekly protein powder and annual Strava subscription.

It’s really useful to see when my subs total is consistently increasing as that’s a good opportunity to review if I’m overspending somewhere.

Accounting for extra purchases

I mentioned earlier about budgets. I’m able to keep my monthly spending fairly even by allocating pots of money away from my monthly budget. This is optional, and dependent on whether you have other income sources or existing savings you plan to use. My full list:

1. Bonus

I was fortunate to receive a work bonus last year, and this ended up providing an essential overflow for various joint purchases and some small individual ones too. This pot has been depleted, but if I have the good fortune to receive another bonus, it’ll go in here.

2. Insurance

I had to claim on a lost wedding ring last year, so these payments came out of this somewhat-transient pot made up of the payout from the insurer.

3. Matched betting

I got into matched betting in a big way in 2020 (lockdown, eh?). Eventually I exhausted its usefulness and got bored of it, but I made a nice sum of money which I put away for my occasional Chelsea tickets. Dubbed my "Chelsea Pot".

4. Health plan

Most of my dentist and optician appointments can be claimed back through my health insurance. This pot covers those payments until I'm reimbursed.

5. Gift

If I’m gifted money for an occasion, It’ll go in this pot. If I buy something using that gifted money, it’ll come out of here.

6. Savings

Most of my personal savings are now in long term investments (another 2020 lockdown project!), but while it was cash in a bank account, it existed in this pot.

What I've learned about my personal spending

Gifts are one of the types of purchases which are hard to scale back when you're budgeting. Gift purchases are on average my biggest monthly expense, and I don't even consider myself an overly generous person. Over time, you learn to make more frugal and shrewed purchasing decisions. But no one likes to come across as cheap to other people, so this takes some practice.

My charitable donations have remained the same despite my disposable income shrinking. What used to be ~1% of my spending is now over 5%. I haven't had the heart to cancel my few recurring donations or stop my occasional sponsorship of a friend.

I'm quite a hobby-rich person, and for me, £250/mo is not enough to satisfy all my interests. However, it is manageable with a little self-restraint and smart credit decisions. Having a limit forces you to assess what's most important to you. For example, fitness & health rank consistently high. Spending on clothes and tech have shrunk significantly.

The recent rise in living costs has caused me to scale back on socialising and the associated costs (drinks, eating out & transport). This is disappointing, as I don't like having to turn down an opportunity to see friends, but this is simply the reality of having a tight budget.

In conclusion

When money is tight, pay yourself an allowance. Review your spending regularly, and fluidly adjust the allowance as your circumstances change. But keep it intentionally small. Categorise your spending based on what is meaningful to you and pay close attention to your spend per type.

Watch those recurring subscription totals. Scheduled payments are useful for budgeting, but don’t let them stifle your ad-hoc budget. Lean on interest-free credit to facilitate larger payments and cost-in the repayments ahead of time.

Software is your friend. Use a combination of databases and spreadsheets. Keep on top of logging your payments - every few days is sufficient for me.